There wasn’t a direct program in place for obtaining $10,000 in loan forgiveness for everyone. However, President Biden has expressed support for providing $10,000 in student loan forgiveness per borrower. It’s important to note that implementing such a program would likely require legislative action, and there hasn’t been a clear timeline or certainty regarding the enactment of such a policy.

That said, there are existing loan forgiveness programs that borrowers can explore, such as Public Service Loan Forgiveness (PSLF) or income-driven repayment plan forgiveness options. Here are some steps you can take:

Stay Informed: Keep yourself updated on any developments regarding potential student loan forgiveness programs. Follow reputable news sources and official government announcements for accurate information.

Advocate: You can advocate for student loan forgiveness by contacting your representatives in Congress and expressing your support for policies that aim to alleviate student loan debt burdens.

Explore Existing Options: While waiting for potential new forgiveness programs, explore existing options like Public Service Loan Forgiveness (PSLF) or income-driven repayment plan forgiveness. PSLF forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments while working full-time for a qualifying employer. Income-driven repayment plans offer forgiveness on any remaining loan balance after 20 or 25 years of qualifying payments, depending on the plan.

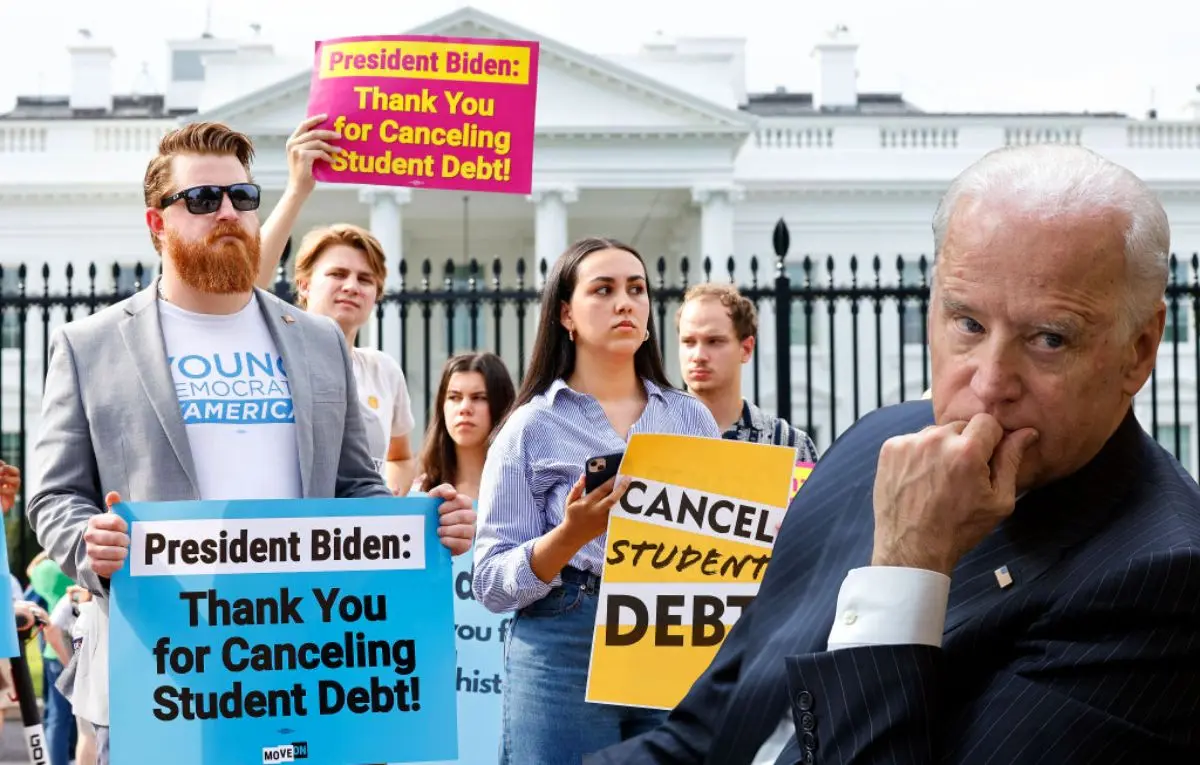

» Did the Biden Administration Announce Cancellation of $1.2 Billion in Student Loans?

Seek Assistance: If you’re unsure about your eligibility for existing programs or need help navigating your repayment options, consider reaching out to a certified financial counselor or student loan advisor. They can provide personalized guidance based on your specific financial situation.

Monitor Changes: Keep an eye on any legislative or policy changes related to student loan forgiveness. Changes in government administration or shifts in congressional priorities could impact the availability of loan forgiveness programs.

Remember, while $10,000 in loan forgiveness would provide relief for many borrowers, it’s essential to assess your individual circumstances and explore all available options for managing your student loan debt.

Read Also: How to Find the Best Truck Accident Lawyer: A Comprehensive Guide